About

FinTech • Digital Banking • AI-Powered Banking Platform

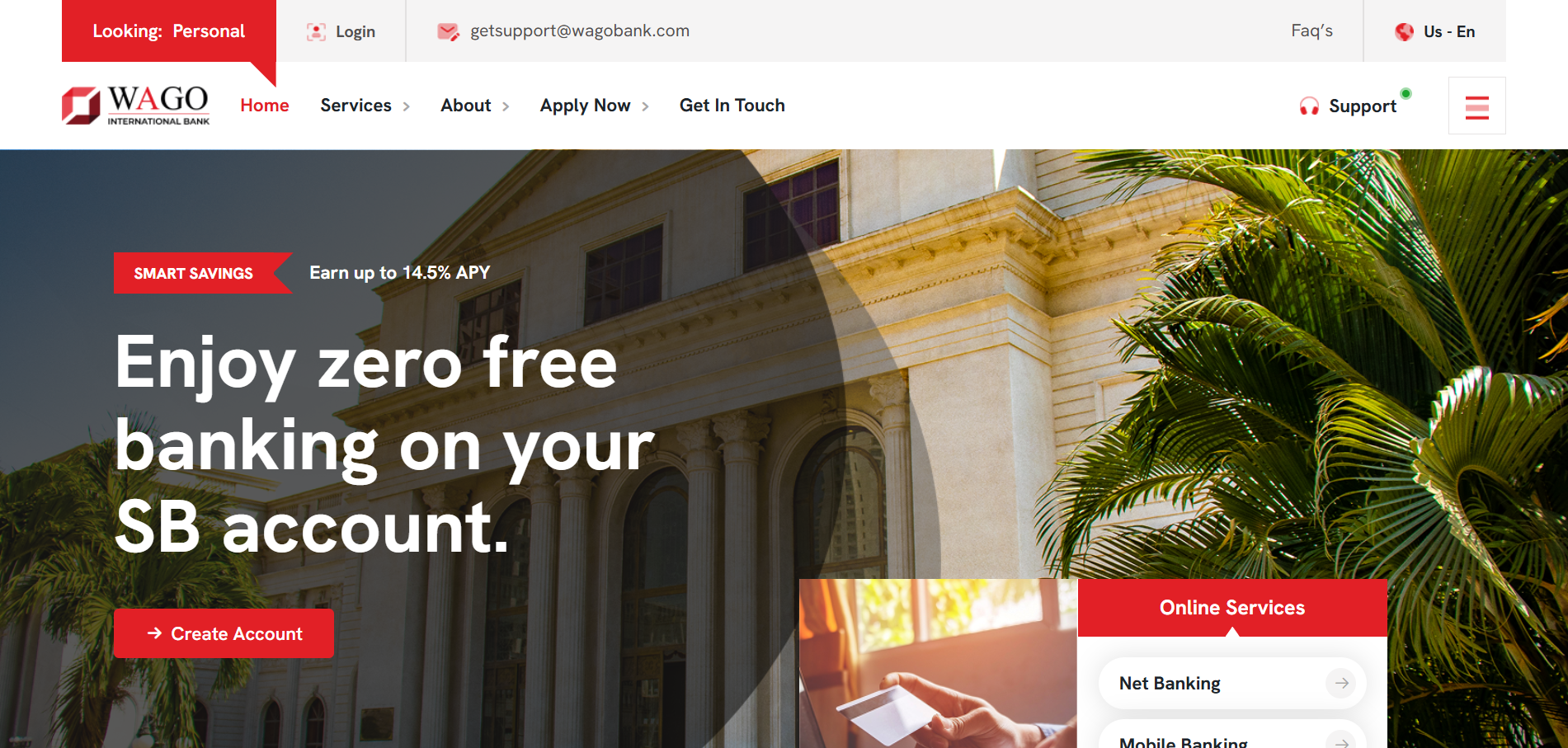

WagoBank required a secure, modern digital banking interface supporting personal and business accounts, loans, cards, deposits, AI-driven insights, and seamless financial workflows. The goal was to build a global-ready, scalable digital banking platform with enterprise security, transparent UX, and intelligent automation.

Platform Overview

WagoBank delivers a next-generation banking experience with unified digital modules for:

- Personal & Business Accounts

- Loan applications, calculators & credit scoring

- Card issuance & management

- Deposits & automated financial planning

- Secure global transactions with audit trails

Challenges

- Implementing secure financial workflows without increasing friction

- Combining multiple banking modules into one unified interface

- Ensuring AI insights were human-friendly, transparent & trustworthy

- Building global security standards (encryption, role-based access, AML)

Research

- Studied fintech UX standards & global banking flows

- Analyzed compliance, KYC, AML, and privacy requirements

- Benchmarked modern AI-driven banking systems

Design & Development

- Modular dashboards for accounts, cards, deposits & loans

- AI-driven insights, risk analysis & predictive charts

- Node.js encrypted APIs + role-based access

- Minimal, trust-centered UI for clear financial interactions

Stats / Results

The new digital banking system improved performance and usability while strengthening security.

| Outcome | Impact |

|---|---|

| User onboarding | 40% faster across banking flows |

| AI fraud alerts | Detected anomalies 3× faster |

| Platform usability | Clearer structure across all banking modules |